Does Las Vegas have a Spirit Airlines Problem?

How much of Las Vegas’s tourism decline is attributed to Spirit airlines?

The vibes in Sin City are decidedly off right now. Lots of articles and news stories have been run talking about the city’s economic decline in the face of “persistent economic uncertainty and weaker consumer confidence”, according to LVCVA.

This coincides with Spirit Airlines struggles. They filed for bankruptcy for the second time in August, and just recently furloughed 400 flight attendants in Las Vegas (1,800 nationwide). Spirit also appears to be throwing in the towel and cutting half of its flights from Las Vegas this fall and winter.

Spirit

Spirit accounted for the 2nd largest airline serving Harry Reid airport in 2024 in terms of passenger boardings. Thus far into 2025, Spirit has lost 32% of it’s market share (1.7 million passengers). At the same time the airport has also seen a 1.7 million passenger decrease across the board [1].

Las Vegas

Las Vegas’s Convention and Visitor’s Authority estimated through August there was a 6.7% decline in in visitor volume year-over-year. They estimate this figure using several different data sources including airport passenger boardings.

International traffic at the airport is down as well. But only down by 2%, as compared to 4.8% for domestic flights. International only accounts for 6% of all boardings [2].

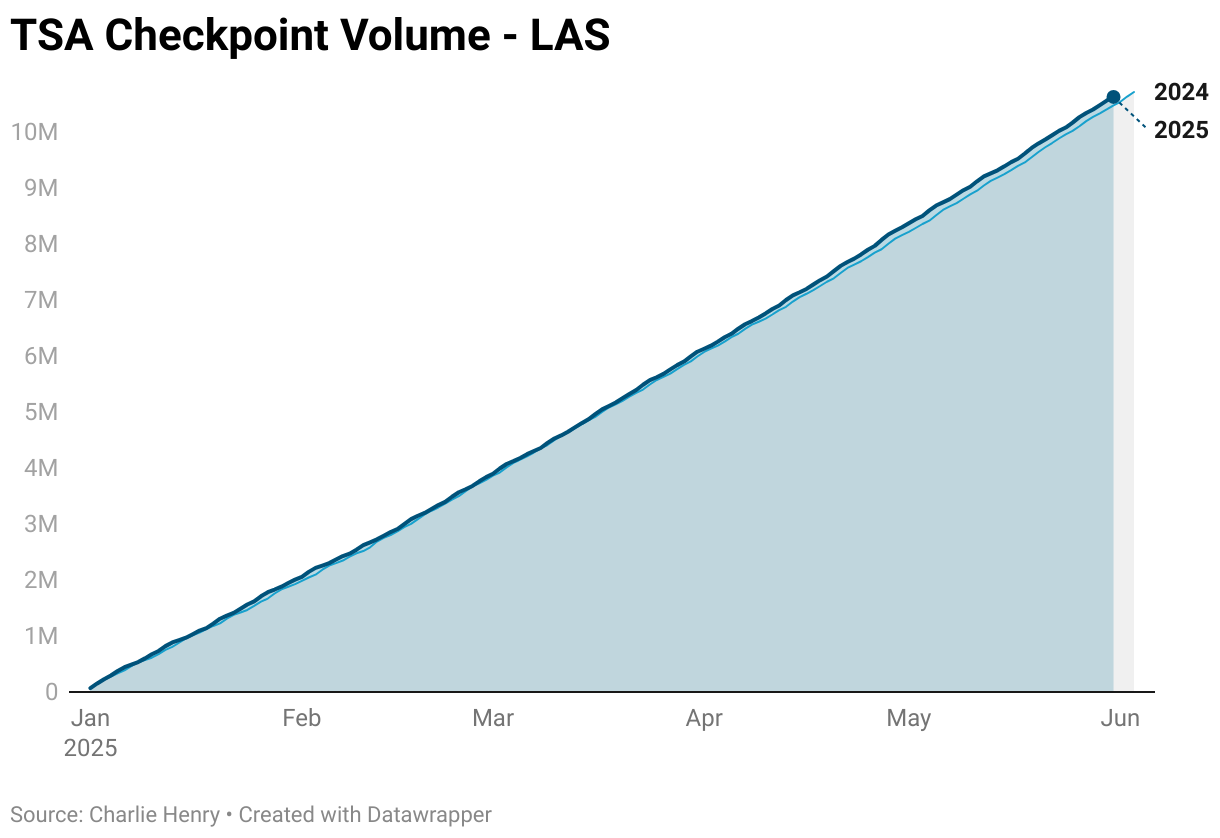

On the contrary, the TSA checkpoint screening count data I publish over on AeroVolumes actually shows a 1.5% increase in year-over-year traffic [3].

Gaming revenue is up, 5.5% on the strip and 8.3% downtown.

The case for “blame Spirit”

Can we place the blame on Spirit for Las Vegas’s tourism slump? The 1.7 million passenger decrease for Spirit reflects that of the airport has a whole seems to suggest they are the only airline dragging everyone down.

Spirit is not the only airline to offer cheap airfares. Frontier airlines is basically even with 2024 (-0.3%) and Allegiant is down 4.3%, both have a similar business model as Spirit classified as “ultra low cost carriers” (ULCCs). Other mainline US carriers have also adopted “basic economy” fares to in order to compete directly with ULCCs

Spirit’s routes to Las Vegas typically come from other large cities. This put them directly in competition with other airlines as well.

This evidence seems to suggest that Spirit’s dysfunction at least shares some blame for the lower tourism numbers.

The case for “blame Vegas”

Spirit passengers are likely some of the most cost-sensitive. These travelers typically book several months out and search for good deals. I don’t have easily accessible data on the cost of a Vegas vacation, but a $26 bottle of water at the Aria is probably the best indicator that the price has gone up significantly. On the other end, inflation has also ate into travel budgets these visitors have.

Spirit’s decline in Las Vegas is more likely to be a symptom that the cost of a Vegas vacation has gotten out of control for most people.

Conclusion

My first adult trip to Las Vegas was a $132 ticket on Spirit departing Oakland at 6AM on a Saturday and returning at midnight on a Monday. I’m sure I wasn’t the only one who became what I call a “Vegas adult” [4] for those who visit Vegas frequently.

One of the biggest reasons I became a Vegas adult was the ease of booking a trip. The flights to Las Vegas are still very affordable (especially during the weekdays) and frequent. You can book last minute and still usually find a decent priced flight.

Spirit’s flight cuts to Las Vegas will in the short term, reduce the amount of competition for several routes which may increase costs further, even for those who don’t travel on Spirit today.

So should we “blame Spirit”? Probably not entirely. Spirit’s collapse is both a cause and a reflection of Vegas’s challenging tourism climate. The next year will tell whether Spirit’s cuts deepen the slump or whether Vegas’s broader cost pressures are the real story.